Collecting, Value, and the Chubb Difference with Chubb's Tannie Ng

Wrist Assured

Dedicated to protecting the timepieces, jewels, and treasures that matter most, Wrist Assured is your monthly insider’s guide: the place where we break down everything you need to know about insuring, safeguarding, and servicing your collection. Because luxury is more than what you wear—it’s what you protect.

Luxury collecting today spans far beyond watches alone, crossing into handbags, jewelry, and objects once reserved for museums. As new collectors enter the market and secondary values surge, understanding how to insure these assets has become as important as acquiring them.

In the second installment of our interview series with Chubb’s Tannie Ng, (read the first one here) we explore what’s driving today’s luxury trends, how collectors should think about value, and why Chubb positions itself differently in a crowded insurance landscape.

Tannie Ng, Chubb’s Vice President of Art, Jewelry & Valuable Collections Manager

CN: Tannie, thank you again for taking the time. Our collectors are so excited to continue to hear from your expertise. What are some of the most surprising luxury trends in the market right now for you?

TN: The luxury handbags market is just incredible to see what's happening today. There was a recent auction record sale of the original Hermès Birkin bag, which sold for $10 million at auction at Sotheby's. That hit the headlines everywhere. I think that, again, by putting this collecting category at the forefront, it's no longer just nice, expensive bags that people are buying to wear. It really has become its own collecting category. You have the big auction houses like Sotheby's dedicating entire departments to that one category. You have a whole secondary market that has developed around it, just like the watch market.

Jane Birkin's original Birkin handbag. Image courtesy Sotheby's.

CN: Speaking of the watch market, is there a specific watch that made you want to be a collector?

TN: Coming from the fine art side and loving art history and design, I think the entry point, for me, into watches was the design. I know for most people it isn’t as exciting anymore, but the Crash by Cartier is iconic. Don’t get me wrong, tool watches are fun, too. I love to learn about the functional side of watches. I think it's incredible how we get so much function in this tiny little movement. Then you have watches like the JLC Reverso that combine both design and function. I love the story behind the Reverso. I think that a lot of watch community enthusiasts, having the story behind the watch, behind the design, and the watchmaker, that's what really pulls us in and gets us excited.

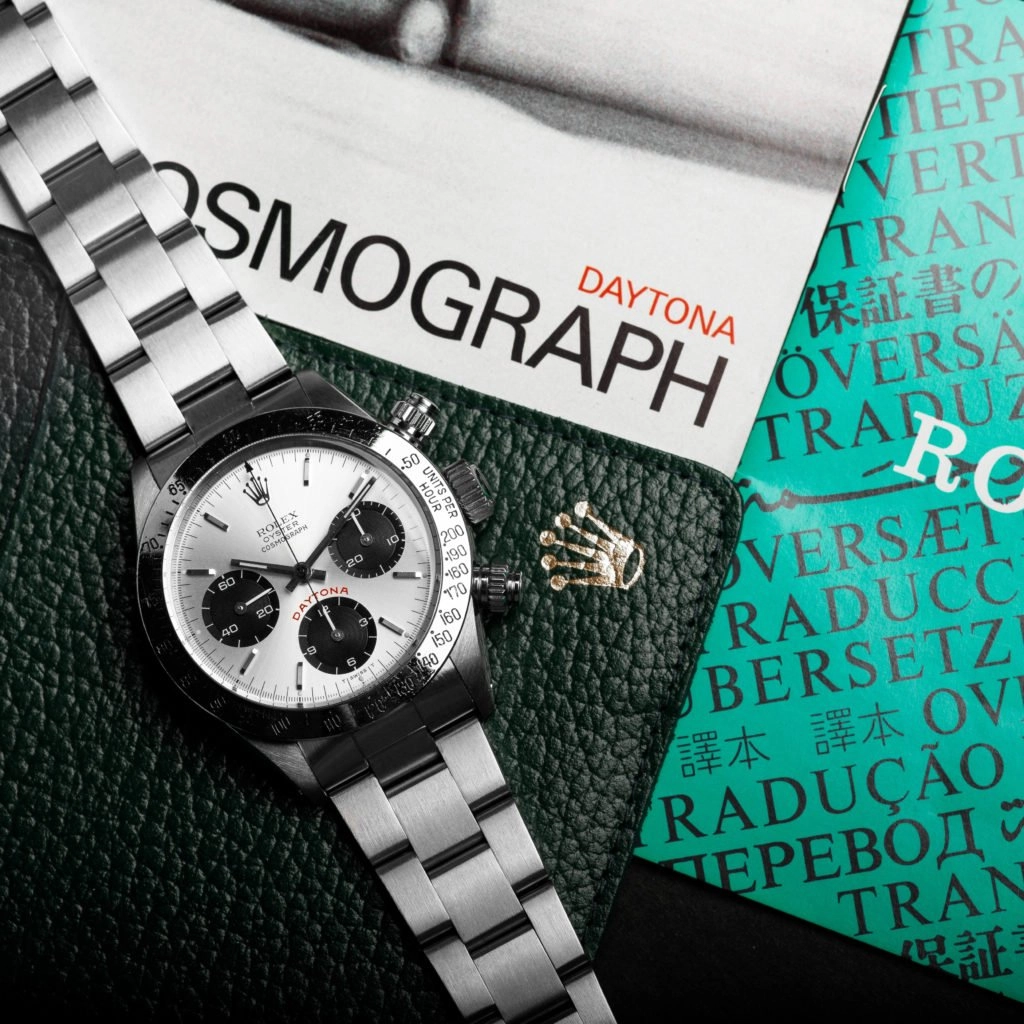

CN: Excitement is such a central tenant of collecting. In fact, my favorite thing about the Chubb policy that we offer is that since it's an agreed insured value, we can insure everything at secondary market value. Meaning, a lot of my job is actually valuing these collections in the secondary market. People are amazed to see what their watches are actually worth. And it really does add up, especially if you've been a Rolex collector for many years and those Rolexes just keep going up and up. It's crazy. You buy an $8,000 Rolex and it's now worth $18,000.

TN: I mean, the fact that they have you also to provide that guidance and that advice, I mean, you've worked on the selling side, the market, it's such value that you're also bringing to your client more than just “please review your policy.” Have there been any changes? You can actually point out some of the areas that they need to really look at, and that's something that we and our team will do. However, being able to do that with you just makes it so much more effective.

CN: Thank you! A question I’ve received a lot from our collectors and something I've noticed is that Chubb's rates can vary significantly based off location. It tends to be like a conglomerate of zip code, county and some other risks, but can you speak a little bit about why location or why rates vary by location?

TN: Definitely. Rates will vary based on several risk factors. Location is going to be one of them. The limit on the values is another consideration, namely, how the collection is protected. So are there central station-monitored alarms? How was the collection protected when you're traveling and wearing your pieces? All of these factors will contribute to the price, creating variations in addition to location, zip code, and the potential for specific areas to be more impacted by natural disasters. That comes into play when discussing location. There is not just one factor that influences price. It really is all of those, what we call risk factors.

CN: We've discussed some amazing resources that Chubb offers its clients. Is there anything we've not touched upon?

TN: I think the fact that we work together on identifying watches or areas of the market that are appreciating is really valuable to our customers. We are constantly looking at different vendors, and when I say vendors, that's everything from shippers to luxury safe companies and vetting additional options for clients, appraisers who have the expertise. And because of the timepiece world, you're talking modern watches, you're talking vintage, you're talking gem-set, there are nuances within the market, so you really want to work with an appraiser who has the expertise within those different areas. Our team is constantly vetting different vendors so that we can really provide support to our customers if they need a referral.

CN: That’s a great point, and a real add-on. Referrals based on real stories and use cases are everything.

TN: I love the stories you have on your end and the conversations you're having. If you see anything where we can provide support, please let us know. It's great to hear that people are now thinking a little more about insurance. Thanks to you, as people who've been buying for years and only thinking now of insurance, I think that says a lot to your knowledge, the service, the value that you're bringing to the community. I think that's exciting for watch collectors, and that they can continue to buy with peace of mind.

If you’re unsure where to start, the most useful first step is boring in the best way: take inventory, sanity-check secondary market values, and pressure-test your protection. Whether that’s home storage, alarms, or travel routines, against the reality of your lifestyle. And if you want a baseline view of what coverage can look like in practice, Cat and the team at European Watch Company can walk you through it and help you understand what your collection is really worth today. Visit EWC’s website to learn more and get the process moving.

This interview has been edited and condensed for clarity.